China is going through a phase of robust growth of biotech companies. This is being boosted by market demand, returning scientists-turned innovators and a favorable capital market, according to BioPlan’s Advances in Biopharmaceutical Technology in China, 2nd ed1. This is especially the case in the Science and Technology Innovation Board in China (STAR) and the Hong Kong Stock Market.

As we note below, the markets for contract bioprocessing are clearly on the rise, and investors, both domestic and international, have seen China’s biologics CDMO landscape as a new growth opportunity. Boehringer-Ingelheim is the first international biologics CDMO to test the waters in China, and the key mover and shaker behinds China’s MAH reform, which opens the door for commercial scale contract bioprocessing.

Lonza,

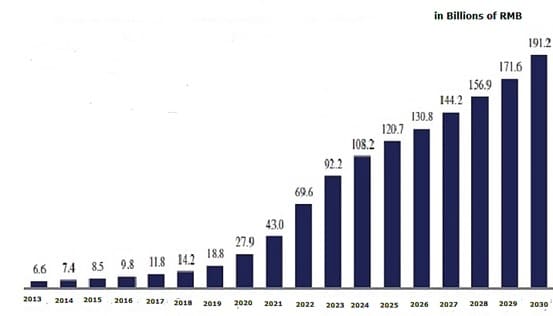

Growth in China’s Biologics Markets

Rapid urbanization, greater accessibility to the national healthcare insurance program, and an aging population has created significant market demands for biopharmaceuticals, which used to be regarded as luxury drugs only available to the wealthy.

Figure 1 China Biologics Market Size Projection

China’s capital markets are also getting more and more interested in biotech and the biopharma industry. The STAR market gives high evaluations (35% above average P/E ratio of all companies listed on it) to life science and healthcare companies,. This is the highest among all sectors including IT, telecommunication, materials and manufacturing, etc.

The exit route via IPO has also encouraged venture capitalists to enter the biotech sector, so much so that hardly a week passes without news about biotech companies successfully raising funds in Series A, B, or pre-IPO rounds. One noteworthy key move is that the STAR market and HK stock market no longer require biotech companies to have marketed products to get listed (STAR market requires biotech companies to have a phase II pipeline for IPO2), which means that capital markets realize the value of pipelines.

For start-up biotech companies, CDMOs have become a must. As innovators with no marketed products, start-up companies have to focus on their key strength, i.e. research and development of the pipeline. They can’t afford to spend the time or their limited financial resources on bioprocessing facilities, which can cost hundreds of millions of RMB or even higher. Worse, the time required to commission a facility would delay the launch of a new biologic by years.

In our June 2020 study, we found a number of domestic biologics CDMOs have been founded between 2018-2020, though the market currently is dominated by one single player, WuXi Biologics. With over a hundred mAb projects currently at clinical stage, and dozens more getting IND from NMPA annually, industry insiders expect China to see ~10 BLA approved each year in the near future, which could translate to an additional 100k liter capacity in demand with a significant portion of it from biologics CDMOs3. The growth of CDMOs also brings market opportunities for single-use supply vendors, as more CDMOs prefer single use systems.

While start-up biotech companies need to partner with CDMOs to speed up the development of their pipeline to IND stage, once their products start clinical trials, many developers will seek funds to build up their own in-house facilities.

References

- Advances in Biopharmaceutical Technology in China, 2nd ed., BioPlan Associates, Inc., and Society for Industrial Microbiology and Biotechnology (SIMB), Oct 2018.

- Yangge, Zhao, Loss-making Zejing Biotechnology Innovation Board IPO has passed: the product has not been sold, and it may not be profitable in the next few years”, Sina Finance, October 31, 2019.

- Growth of Biopharmaceutical Contract Organizations in China, BioPlan Associates, Inc. June, 2020