Creating Bottlenecks in Europe; Opportunities for Production Staff

BioPlan Associates, Inc.

Hiring of bioprocessing professionals has remained a stubborn problem over the past 11 years, and will only get worse, according to BioPlan’s 17th Annual Report and Survey of Biopharmaceutical Manufacturing[1]. This is bad news for bioprocessing, but potentially good news for experienced staff seeking career advancement. As demand for expertise grows, the supply of qualified staff will continue to get tighter. This can be particularly challenging for start-up companies who need to attract skilled, experienced staff.

This skills shortage will get worse as competition for expertise grows: New facilities, new technologies, biosimilars, cell and gene therapies, industry expansion to developing markets, notably China and elsewhere are contributing to the ‘pinch’.

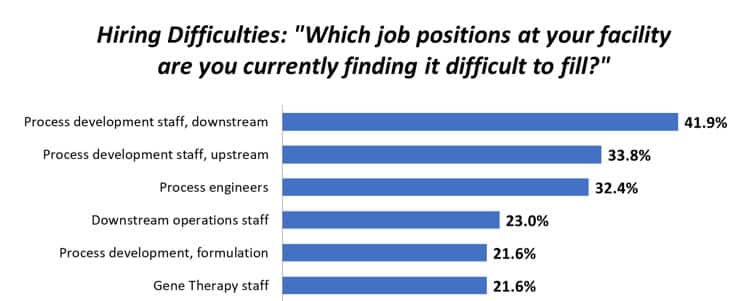

Figure 1: Selected Areas where Hiring Difficulties at Biopharma Facilities Exist (Preliminary Data)

Source: 17th Annual Report and Survey of Biopharmaceutical Manufacturing, April 2020 BioPlan Associates, Inc. www.bioplanassociates.com/16th

Gene therapy staff are particularly hard to find. Challenges were noted by 21.6% of respondents; but when you consider that Gene Therapy facilities make up a minority of respondents, we take this to mean that closer to 100% of GT facilities are experiencing real pain.

Hiring Difficulties in Europe vs US

Facilities in Western Europe are reporting significantly more serious hiring difficulties than in the U.S. (57.5% of Western European respondents vs 41% in the US reported difficulties hiring downstream process development staff, for example). Similar gaps exist for process development upstream staff hiring.

Bottlenecked production can potentially amount to millions of Euro/Dollars in lost revenue for delays in drug launches, etc. So this is serious business. And it’s not an easy fix.

Figure 2: Hiring Difficulties U.S. vs Western Europe

Source: 16th Annual Report and Survey of Biopharmaceutical Manufacturing, April 2020 BioPlan Associates, Inc. www.bioplanassociates.com/16th

Differences in hiring between the U.S. and Western Europe might have to do with the stage of development in different regions, where hiring status and patterns will differ. The U.S. difficulties (shortages) are mostly in areas involving process engineering and validation.

Hiring practices are also different in Western Europe vs. the United States and may be affecting related shortages. European employees may work under employment contracts vs. “at will” employment in the U.S. This may have the effect of raising the cost of organizational change, leading to a less fluid labor market in the EU.[2]

Ten-Year Challenges

Finding bioprocessing and cell culture process specialists with high levels of expertise has always been a challenge. Despite continued demand and shortages, few major training initiatives or changes appear to be occurring. The difficulties in hiring we see may well reflect the fact that facilities want to hire highly qualified employees. Not beginners. Further, as bioprocessing becomes more complex, so does the demand to hire uniquely qualified staff.

Problems with staffing are particularly troublesome concerning process development. Over the past 11 years, hiring of process development professionals, has continued to be the most commonly cited area in which facilities are reporting difficulties. “Process development staff, downstream” was the number 1 most difficult to fill area this year, cited by 41.9%. “Process development staff, upstream” showed up at 33.8%, followed by process engineers. (See Fig. 1)

Figure 3: Ten-year Hiring Difficulties Trends, 2010-2020

Source: 17th Annual Report and Survey of Biopharmaceutical Manufacturing, April 2020 BioPlan Associates, Inc. www.bioplanassociates.com/16th

Solutions

There are scores, if not hundreds of global universities, from New Delhi, to Cambridge, to Boston, offering bachelor and master’s degrees in biotechnology. There are a handful of bioprocess-dedicated training facilities in US and Europe but even these are not enough to meet the growing need. Even with the dozens of community colleges training for basic GMP operations, and vendors that offer unique training for operations on their proprietary technologies, demand consistently outstrips supply.

Over the past 17 years, BioPlan have surveyed this industry regarding the need for staffing. But there appears to be no real substitute for on-the-job training. Once graduates are hired, they tend to spend 6-12 months in training by supervisors or others who provide the needed hands-on knowledge and expertise.

Another approach facilities are taking is to invest in improvements in productivity and efficiency (producing more with fewer staff and resources). This focus on efficiency has been the #1 trend in this industry segment for nearly 10 years, and is likely not just because of the need to contain costs, but because facilities need to use the people they have most effectively, since supply of more staff is so tight. We can expect more automation and cutting-out of process operation steps in the future.

Conclusions

More experienced people are clearly needed. Contrary to what some believe is driving the capacity bottlenecks, (e.g., facility strategies, equipment and hardware), bioprocessing efficiency, productivity and product quality is driven by effective staffing strategies. Programs need to be place to support effective bioprocessing including hiring strategies, training and retraining programs, along with recognition that retention of high-quality, highly educated people. And this is not easy! It’s a very long-term process requiring attention and investment.

References:

- 17th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production, Preliminary Data, March 2020, BioPlan Associates, Inc, Rockville, MD.

- 16th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production, April 2019, BioPlan Associates, Rockville, MD.

BioPlan Associates is a strategic consultancy and publisher that has provided biopharma and life sciences organizations with market analysis, valuation and strategy since 1989.